10 Simple Techniques For Financing Bad Credit

Table of ContentsFinancing Bad Credit - QuestionsGetting My Financing Bad Credit To WorkGet This Report about Financing Bad CreditHow Financing Bad Credit can Save You Time, Stress, and Money.Some Known Details About Financing Bad Credit See This Report on Financing Bad CreditThe Definitive Guide for Financing Bad Credit

The month-to-month installation is the amount of money you pay to the loan provider every month. Divide the sum by the total quantity of months you will certainly take to repay your finance totally.Prior to you get any personal car loan for poor credit scores, you need to examine a minimum of the term as well as the rates of interest to identify if you will certainly be comfy paying back the financing. With Slick Cash Funding, you will certainly obtain a highly tailored term to make certain that you repay your car loan successfully.

This rate includes the principal amount, the passion, the car loan handling charge, or what several individuals call the loan provider fee. Considering that, at Glossy Cash Money Financing, we provide the very best rates of interest and also very reasonable handling charges. We still think that we have the very best APR on individual finances for poor debt in the United States.

Some Known Questions About Financing Bad Credit.

The financing agreement additionally lays out the precise procedure for late repayments. An individual should completely understand the procedure and also any prospective repercussions before accepting the funding. If you have a poor credit report due to an absence of credit report background, personal car loans for bad credit scores will help expand your credit score background.

Poor credit history Individual lendings are extremely convenient. One can use from the convenience of your house or anywhere they have accessibility to the web. Unlike financial institutions and also mainstream lenders, the candidate never has to have a physical conference during the approval process. The finance is straight debited to their savings account in as little as 24 hrs once the application is effective.

If you have a past due account, you must pay it before requesting an individual lending for bad credit history. If you can not get an individual car loan for negative credit score, you must add a co-signer to the mix. A co-signer is an individual with a good credit report and also a good earnings.

The Definitive Guide for Financing Bad Credit

As well as all you need to do is finish the on-line application to get approved for personal loans for poor credit up to a crazy $5000. Don't let a poor credit rating prevent you from living your life to its max. There are numerous reasons why a person might require to look for an on the internet loan.

Or maybe to avoid their household from getting in any kind of financial trouble. Whatever your factors might be, using for a negative credit history financing today is a significant action towards monetary flexibility. Personal finances for poor debt are currently a staple in all edges of the United States. Total our finance application, as well as you will understand why getting a lending, despite having a negative credit history, is much easier currently than ever.

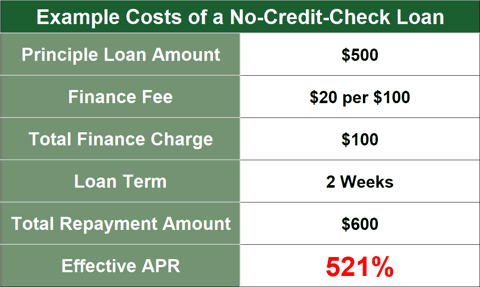

They are meant to help people that need a tiny amount of money in the brief term, such as to pay for a clinical emergency or individual expenditures. These fundings' APR and other terms rely on the customer's credit rating. Typically, bad credit personal finances have higher rate of interest prices than typical lenders.

The Main Principles Of Financing Bad Credit

Some personal car loans can be used for online, while others need to be requested in individual. While making an application for a personal financing, you ought to supply necessary economic as well as personal information to establish the lending's eligibility. Most negative credit rating personal financings are rapid and also simple to fund. Getting an individual financing with negative credit scores may appear difficult.

These lenders will certainly have their requirements for a lending, however the fundamental idea is to make certain that the person can settle the money. Borrowers can acquire these fundings from banks, credit unions, or quick online loan providers - financing bad credit. When looking for a financing, customers prioritize variables such as the most affordable rate of interest, charges, as well as credit rating requirements.

They ought to understand what type of car loan they are applying for and whether they will certainly require a co-signer. While a lot of poor debt lendings are secured, unprotected finances are additionally offered.

The Of Financing Bad Credit

The drawback to using straight with a lender is that you only obtain one finance offer. When you approve an offer, you can generally wait one company day prior to receiving the financing earnings.

It's ideal to use with a straight loan provider that concentrates on helping individuals with negative credit score. In addition, neighborhood lenders may have the ability to offer a lot more competitive terms as well as lower charges than online loan providers. When contrasting personal financings for bad credit, it's crucial to comprehend just how Homepage much interest they charge as well as for how long it will certainly require to repay the funding.

Not known Facts About Financing Bad Credit

Still, these prices can be lowered if you contrast the various deals and fees. Personal fundings likewise range in payment terms from 24 months to 60 months. Typically, the longer the repayment term, the lower the rate of interest and also the reduced the month-to-month settlement. When it pertains to acquiring a personal car loan, bad credit history typically limits your options.

If you're late, you might discover that you're subject to significant fees and fines. When looking for a poor credit loan, make certain to think about several lending institutions prior to making a decision which one will be the best for your scenario. Numerous lenders supply finances to individuals with bad credit rating, consisting of cash advance and also alternative installation finances.

Get This Report on Financing Bad Credit

Individual financings for people with bad credit are readily available from various sources, from cooperative credit union to on the internet lending institutions. Cooperative credit union may require a lending institution membership to apply, however you do not have try here to be a member to close the finance. Online lending institutions generally need an on-line application and documentation to confirm your identity, address, and income.

This decrease is especially obvious on greater ratings. Late repayment likewise boosts the rate of interest, and also lending institutions might not agree to forgo late charges. Luckily, many lenders offer individual loans for people with inadequate credit rating (financing bad credit). The procedure is a little bit much more challenging than for individuals with ideal credit history, there are methods to get accepted for one.